One of our client a game changer in hydrogen solutions, Hydrogen de France, led us to research and analyse on how we can support with our people, process and digitisation expertise the companies in the energy-renewables and the mobility-transport-automotive sectors. There are strong upcoming players putting into a reality the European policy for autonomy on strategic ecosystem and on climate neutrality by 2050. They are facing hypergrowth.

Context: Europe policy for autonomy on strategic ecosystems:

The European Commission has clearly stated its ambition for a strategic autonomy both in industrial and digital. The focus on 14 ecosystems which are aerospace and defence, agri-food, construction, cultural and creative industries, digital, electronics, energy intensive industries, energy-renewables, health, mobility – transport – automotive, proximity, social economy and civil security, retail, textile and tourism are also integrating the agenda for climate neutrality by 2050. (1)

The report also highlighted 6 strategic areas where UE should have independency: raw materials, batteries, active pharmaceutical ingredients, hydrogen, semiconductors, cloud and edge technologies.

Bearing in mind that in the Battery sector only 3% of the production of li-ion battery cells in 2018 were made in Europe ( 66% in China and 20% in South Korea, Japan and other Asian countries) a significant action and policy had to be introduced -and was- with an impressive “€60 billion investments in Europe’s electro mobility value chain in 2019 alone, mostly private = 3.5 times as much as China”. (2) not to mention important investments in research (€270 million and €925 million under Industrial Battery Value Chain under Horizon Europe (3). Finally, under the Important Projects of Common European Interest (IPCEI) €3.2B state aid should leverage €5B in private sector investments plus the second IPCEI €2.9B grant should lead to €9B in private sector investments.

Regarding the Hydrogen sector and under the umbrella of the IPCEI Hy2Infra, seven member states (France, Germany, Italy, the Netherlands, Poland, Portugal, and Slovakia) will provide up to €6.9B in public funding that should unlock €5.4B in private funding. The 32 companies will participate in 33 projects to deploy large-scale electrolysers to produce renewable hydrogen, hydrogen transmission and distribution pipelines of approximately 2,700 km, large-scale hydrogen storage facilities with capacity of at least 370 GWh and the construction of handling terminals and related port infrastructure for liquid organic hydrogen carriers (‘LOHC’) to handle 6,000 tonnes of hydrogen a year.(4)

Integral path to success: People and Digital Transformation:

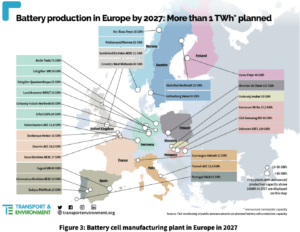

Europe has today planned 50 gigafactory projects (5) for the battery production by 2027

Source: https://evmarketsreports.com/europes-battery-supply-to-ramp-up-by-2030

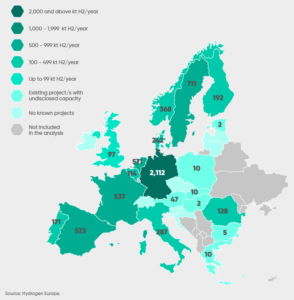

Europe has today 242 manufacturing plants for hydrogen.

Source : https://joint-research-centre.ec.europa.eu/jrc-news-and-updates/water-electrolysis-and-hydrogen-growing-deployment-prospects-europe-and-beyond-2023-11-24_en

Talking Hypergrowth : as an example, if we zoom on our customer HDF Energy, Hydrogène De France presented its commercial activity for 2023 and its accounts with a promising trajectory.

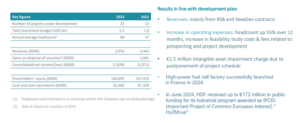

Indeed the key figures (6) of HDF Energy published end of 2023 highlight impressive growth figures:

Key take aways of the report are:

- a significant increase of projects portfolios “that are recognized by international financiers as technically reliable and economically relevant solutions” (i.e: project in Barbados is the first project supported by the World Bank and the Green Climate Fund (GCF).) “HDF estimates that it will be able to generate, during the development and construction phases of a project, a turnover of between 12% and 17% of the construction cost, including engineering services and the supply of batteries. fuel during the construction of the power plant.”

- a stable turnover at €3.9 million (compared to €3.5 million in 2022)

- Human capital: average workforce (employees and contractors) reaches 112 people in 2023 compared to 39 in 2021, an increase mainly linked to the doubling of technical expertise dedicated to projects and the industrial program. (7)

In this context of hypergrowth, HDF Energy Procurement and IT Team combined with KaOra Partners and Cyrias was the combination to a successful project delivered in three months. KaOra brought expertise in framing the project, S2C vendor selection and Data quality monitoring and Cyrias its procurement and Digital Transformation expertise deployed on the Ivalua SaaS cloud platform.

The initial mission for Cyrias was to embrace the constraints of a project that would lay the foundation for a tool that would grow in time with HDF Energy expansion. Our project approach was somehow similar to international ones for larger organisations (destined to scale up with on boarding new regions and organisations and M&A). In this case we have to start with an emphasis on the design phase for the core model that would include future projects and plants. It requires a flexibility in budget and people staffing that is a strength of Cyrias.

Laying the foundations for the Procurement function in this case was implementing the S2C (Source 2 Contract) from our partner Ivalua.

This solution first goal is to streamline collaboration between procurement, finance and legal at HDF Energy but even more important to provide a collaboration platform with a fast growing supplier database.

Once a clear supplier database with all the supplier data & metrics ensuring a 360° view of each supplier combined with category management (direct- indirect), the Ivalua powerful RFx (Request for Information, Proposal, Quote) solution was configured with the expertise from HDF Energy Procurement team (often coming from larger companies like Schneider Electric or Safran Group equipped in similar tools and processes). The cycle ends with awarding the RFp with a till signature contractualization process also managed in Ivalua. Harmonised process, transparency of information and reporting in one platform.

These optimised process within one configurable and scalable solution like Ivalua ensures compliance and transparency that the Procurement policy needs but not only.

Again in a capital intensive industry like the new energy Reporting is crucial. Why: profitability has not been reached, transparency needs to be shown, financial gains and regulations compliance as well, a few examples:

- Procurement has to address the risk of supply chain disruption with the right evaluation of the supplier and risk diversification.

- Procurement has to show investors credibility with reports on compliance in the procurement policy with all ESG requirements in the new energy sector.

- Collaboration plans with the supplier on co-development and reducing time to market cycles.

Conclusion:

In a context of hyper growth industries, in a time of 4.0 industrial revolution and Artificial Intelligence people are the heart of successful digitisation projects. They are key in giving fundamentals and frame to structure fast growing companies with the right processes, teams and tools.